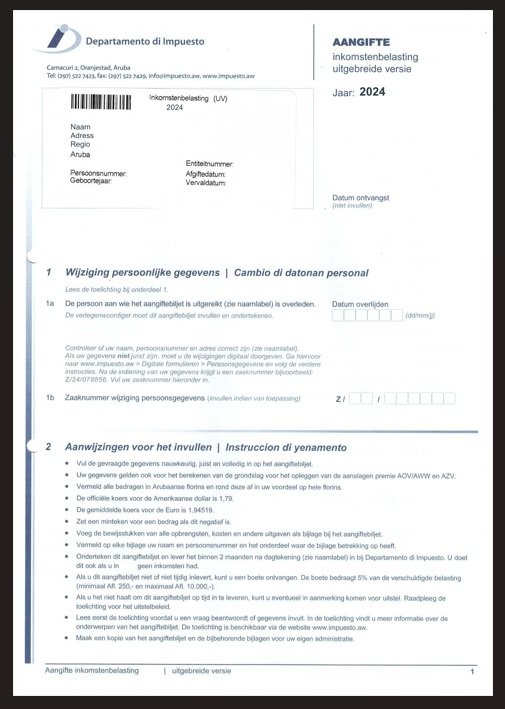

Personal Income Tax Return / Inkomstenbelasting 2024 - Aruba

Filing your personal income tax return can often feel overwhelming, but with the right information and resources, it doesn't have to be. Here’s a comprehensive approach to ensure your tax return is accurate, timely, and optimized for your financial situation.

Key Steps for Filing Your Personal Income Tax Return

Gather Your Documents:

Wage Summary Forms: Collect all forms from employers.

VOD Forms: If you're a freelancer or received interest, gather verzamelloonstaat op derden forms.

Receipts and Statements: Organize receipts for deductible expenses, such as medical bills, education costs, and charitable contributions.

Last Year’s Tax Return: Use it as a reference point for consistency.

Choose the Right Filing Method:

DIY Software: Consider tax software for an easy-to-understand interface that guides you through the process.

Professional Assistance: Engage a tax professional if your tax situation is complex, especially with investments, multiple income sources, or major life changes.

Know Your Deductions and Credits:

Standard Deduction vs. Itemized Deductions: For 2025, the standard deduction amounts are crucial. Evaluate whether itemizing provides a greater benefit based on your eligible expenses.

Tax Credits: Investigate credits for education, energy efficiency, and child care that may lower your tax liability significantly.

Be Aware of Deadlines:

Typically, individual income tax returns are due on April 15. If needed, file for an extension, but remember that this doesn't extend the time to pay any taxes owed.

Review and File Electronically:

Double-check Information: Ensure all names, Social Security numbers, and figures are accurate to avoid delays or penalties.

E-File for Speed: Electronic filing is not only faster but also more secure and often comes with direct deposit options for refunds.

Plan for Payment:

If you owe taxes, consider payment options such as direct debit or setting up an installment payment plan with the IRS if necessary.

Post-Filing: What’s Next?

Keep Records: Maintain copies of your filed return and all supporting documents for at least three years.

Monitor Your Refund: Track the status of your refund to stay updated on any processing delays.

Conclusion

Navigating your personal income tax return can be a seamless process with the right preparation and knowledge. By staying organized and informed, you can maximize your deductions and credits, file on time, and minimize your stress during tax season. At L&M Tax Consultancy, we pride ourselves on providing innovative solutions to simplify your tax filing experience.

Personal Income Tax Return / Inkomstenbelasting 2024 - Aruba

Filing your personal income tax return can often feel overwhelming, but with the right information and resources, it doesn't have to be. Here’s a comprehensive approach to ensure your tax return is accurate, timely, and optimized for your financial situation.

Key Steps for Filing Your Personal Income Tax Return

Gather Your Documents:

Wage Summary Forms: Collect all forms from employers.

VOD Forms: If you're a freelancer or received interest, gather verzamelloonstaat op derden forms.

Receipts and Statements: Organize receipts for deductible expenses, such as medical bills, education costs, and charitable contributions.

Last Year’s Tax Return: Use it as a reference point for consistency.

Choose the Right Filing Method:

DIY Software: Consider tax software for an easy-to-understand interface that guides you through the process.

Professional Assistance: Engage a tax professional if your tax situation is complex, especially with investments, multiple income sources, or major life changes.

Know Your Deductions and Credits:

Standard Deduction vs. Itemized Deductions: For 2025, the standard deduction amounts are crucial. Evaluate whether itemizing provides a greater benefit based on your eligible expenses.

Tax Credits: Investigate credits for education, energy efficiency, and child care that may lower your tax liability significantly.

Be Aware of Deadlines:

Typically, individual income tax returns are due on April 15. If needed, file for an extension, but remember that this doesn't extend the time to pay any taxes owed.

Review and File Electronically:

Double-check Information: Ensure all names, Social Security numbers, and figures are accurate to avoid delays or penalties.

E-File for Speed: Electronic filing is not only faster but also more secure and often comes with direct deposit options for refunds.

Plan for Payment:

If you owe taxes, consider payment options such as direct debit or setting up an installment payment plan with the IRS if necessary.

Post-Filing: What’s Next?

Keep Records: Maintain copies of your filed return and all supporting documents for at least three years.

Monitor Your Refund: Track the status of your refund to stay updated on any processing delays.

Conclusion

Navigating your personal income tax return can be a seamless process with the right preparation and knowledge. By staying organized and informed, you can maximize your deductions and credits, file on time, and minimize your stress during tax season. At L&M Tax Consultancy, we pride ourselves on providing innovative solutions to simplify your tax filing experience.